Will you owe more on your vehicle loan than your vehicle is worth?

Guaranteed Asset Protection is like an airbag for your vehicle loan.

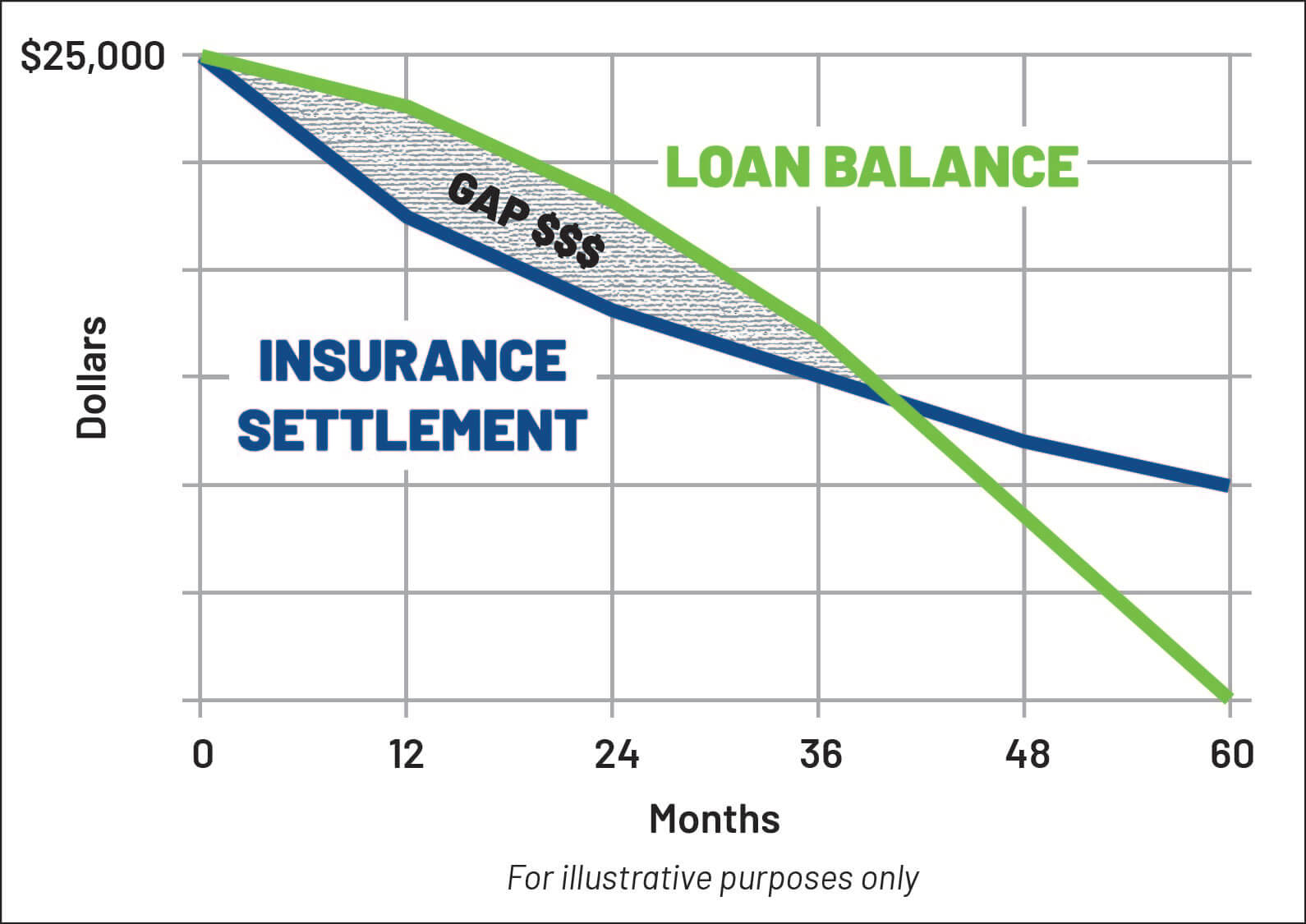

A wrecked vehicle can wreck your finances if you owe more on your loan than your insurance will pay.

The second you drive your new vehicle off the lot it drops in value. More than 20% after one year. This creates a gap in coverage.

Our Guaranteed Asset Protection (GAP) program may reduce or eliminate the gap between what your vehicle insurance will pay and what you owe on your loan, if your vehicle is deemed a total loss. It can help cushion you and your family against sudden out of pocket expenses.

Get GAP today so you can worry a little less about tomorrow.

Auto Deductible Reimbursement

A complimentary benefit provided by your credit union

Our Guaranteed Asset Protection (GAP) program includes Auto Deductible Reimbursement (ADR), which is designed to provide financial relief when your vehicle is damaged but not deemed a total loss. If repairs cost more than your deductible, the deductible amount is applied to your vehicle loan at the credit union, reducing what you owe. ADR covers vehicles registered in your name and insured under your individual primary auto insurance policy.

*Car Depreciation: How Much Value Will a New Car Lose? CARFAX, Nov. 9, 2018.

Your purchase of MEMBER’S CHOICETM Guaranteed Asset Protection (GAP) is optional and will not affect your application for credit or the terms of any credit agreement you have with us. Certain eligibility requirements, conditions, and exclusions may apply. You will receive the contract before you are required to pay for GAP. You should carefully read the contract for a full explanation of the terms. If you choose GAP, adding the GAP fee to your loan amount will increase the cost of GAP. You may cancel GAP at any time. If you cancel GAP within 90 days you will receive a full refund of any fee paid.

GAP purchased from state chartered credit unions in FL, GA, IA, RI, UT, VT, and WI, may be with or without a refund provision. Prices of the refundable and non-refundable products are likely to differ. If you choose a refundable product, you may cancel at any time during the loan and receive a refund of the unearned fee.

GAP purchased from state chartered credit unions in CO, MO, or SC may be canceled at any time during the loan and receive a refund of the unearned fee.

GAP purchased from state chartered credit unions in IN may be with or without a refund provision. If the credit union offers a refund provision, you may cancel at any time during the loan and receive a refund of the unearned fee.

GAP-2453265.1-0319-0421 ©2019 CUNA Mutual Group, All Rights Reserved.

CUNA Mutual Group is the marketing name for CUNA Mutual Holding Company, a mutual insurance holding company, its subsidiaries and affiliates. Additional terms and conditions apply, complete details are provided in the Evidence of Coverage distributed upon our provision of the benefit to you. Auto Deductible Reimbursement Coverage will be provided to members under a blanket policy issued to participating credit unions. The Auto Deductible Reimbursement Coverage is underwritten by Arch Specialty Insurance Company.

©2018 CUNA Mutual Group, All Rights Reserved.

CARMA#: GPM611 † MARKETING#: GAP-2287437.1-1018-1120

Go to main navigation